Checking your credit score may be the last thing you think about before booking a holiday, but it would be vitally important.

Checking your credit score may be the last thing you think about before booking a holiday, but it would be vitally important.

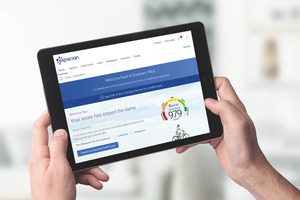

Check your credit rating before going away, with CreditExpert.co.uk.

Many people don’t realise the benefits a free credit score search could bring them until they need to borrow money. Everyone needs a holiday to relax once in a while, but deciding whether you can afford one is a stressful business. Fortunately, better access to credit has allowed most of us the opportunity to take advantage of the deals offered by many travel specialists when they are their most reasonable, not when they reach their most expensive.

A good understanding of your creditworthiness could therefore be the difference between the holiday of a lifetime, or pottering around the house doing your usual chores. It doesn’t end there, either. Your credit history can affect everything from your mortgage to your ability to take out store cards or purchase a new car. Even if you still have access to credit, you could be being charged a punitive rate of interest on your purchases. Finding out your free credit score is therefore well worthwhile, especially when offered for free.

Experian, the longest-established and largest credit bureau in the UK, are offering you the opportunity to see how good your credit history really is. Even if you haven’t borrowed heavily in the past, a credit check may be a good idea. Many people each year have higher borrowing costs because of mistakes in their previous payment history. Why let a forgotten mobile phone bill cost you the holiday of your dreams?

Much has been said of the dangers posed by identity fraud, but it remains a sad fact that we are living in an age where it is easier to steal an identity and wrack up credit against an unsuspecting person’s record than ever before. Experts estimate the cost of identity fraud at £1.7 billion a year. Worryingly, it seems that the average amount of time it takes a person to discover identity fraud carried out in their name is more than a year.

Allowing a company like Experian to obtain your free credit score once in a while will help protect against fraud. Even if you’ve discovered and recovered financially from fraud, a credit check should give you the opportunity to see whether any past instances of identity fraud are held against you. Experian’s CreditExpert also gives you free Identity Fraud Expenses Insurance, to protect you from having to pay costs.

Experian’s CreditExpert.co.uk allows you to protect yourself against these threats and increase your scope of opportunities. Their services give members access to information about their credit history, credit checks made against their name, and the opportunity to speak to a credit expert about any concerns you may have over your report.

By regularly checking your credit report, you will develop a better understanding of how lenders make decisions and make sure the information is correct.

CreditExpert.co.uk is a safe way of monitoring your finances. In the UK today, there are unfortunately many credit repair companies that will promise to improve your credit rating. In fact, some may make matters worse by encouraging you to break the law or offering a very high interest rate loan, causing you further difficulties.